Finding consensus among investment outlooks

Abstract

This report will disclose the most controversial commonalities within each of the market outlooks released on the List of Market Outlooks for 2023. These predictions are only what the bulge bracket banks and investment firms foresee from the data they had accessible at the end of 2022. The markets and inflation are unpredictable, so these outlooks are not set in stone. The most controversial topics for 2023 are equities, fixed income, U.S. growth and recession predictions, and ESG.

Equities

The S&P 500 declined 19% in 2022, marking its worst year since 2008. The majority of these market outlooks for 2023 discuss how equities and corporate earnings forecasts have yet to price in a recession entirely but are threatened by rising rates and reduced demand. The view of a recession being priced into stocks remains split amongst banks and investment firms. However, many banks expect a decline in 2023 earnings which will also bring the stock market down. Fidelity International mentions that if USD strengthening persists, this will erode earnings. Citi expects a 10% decline in corporate earnings, which is why they are confident in high-quality stocks with dividends that provide a quality income rather than a high income. Banks and investment firms are targeting consumer staples, utilities, energy, and health care as the most attractive sectors for investing in equities. They see potential opportunities in value and large-cap stocks in 2023 due to their historical performance during recoveries and their valuation metrics.

Marci McGregor, a Senior Investment Strategist at Bank of America, believes the most essential economic indicators to watch for in 2023 are Initial Jobless Claims, Investment Grade Option-Adjusted Spread, High Yield Option-Adjusted Spread, and the U.S. Yield Curve. Historically, these indicators are known for signaling red flags when an economic slowdown is beginning to unravel. But overall, capital markets will likely remain vulnerable in 2023.

Fixed Income

The year 2022 experienced a significant correlation between stocks and bonds due to rising rates and sticky inflation. JP Morgan expects the correlation for these two asset classes to continue into 2023. However, Credit Suisse expects this correlation to decrease if growth risks become evident. If the economy continues to weaken in 2023, spreads can continue widening.

Yields have become more attractive to investors to make up for inflation. As inflation decreases, yields will remain volatile, while many banks have different expectations for bond yields. The main consensus believes yields will peak and possibly fall in late 2023. With sticky inflation, uncertain growth, and volatile short-term government bond yields, JP Morgan notes that allocating along the fixed income curve and taking more duration can be one strategy for 2023.

Going into 2023 with higher rates, many banks believe the most attractive fixed income criteria are high-quality short-term securities due to their higher yield. Locking in higher yields for long-duration securities is only preferable if rates are expected to decline by the end of 2023. While the yield on low quality looks attractive, this is riskier due to their higher chance of suffering if the event of a recession. If the USD strengthening continues to decrease, quality Emerging Market bonds will look more appealing to investors.

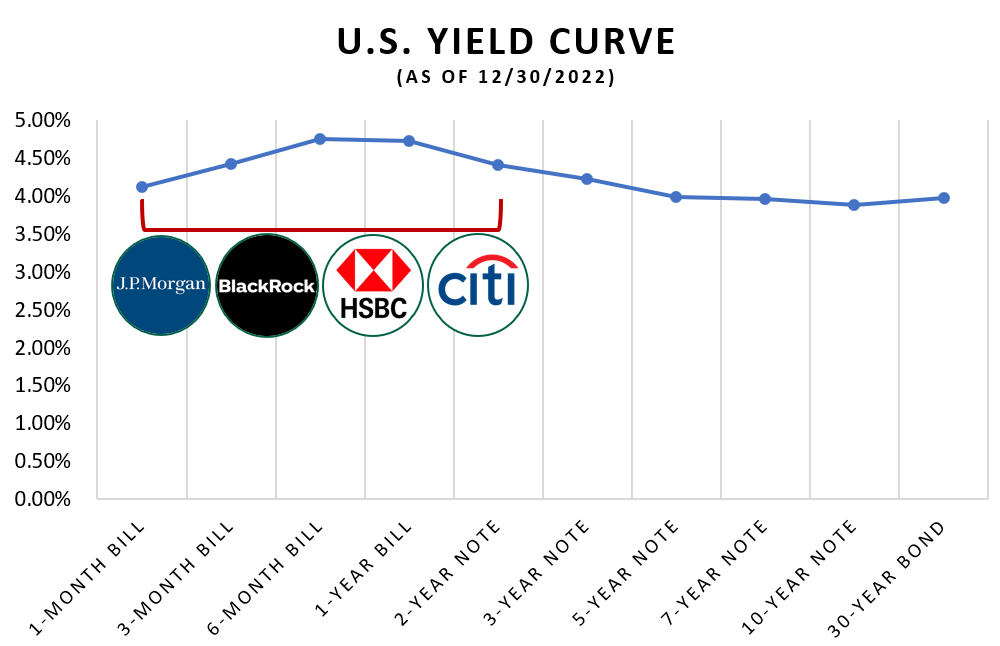

Current recommended yield allocation:

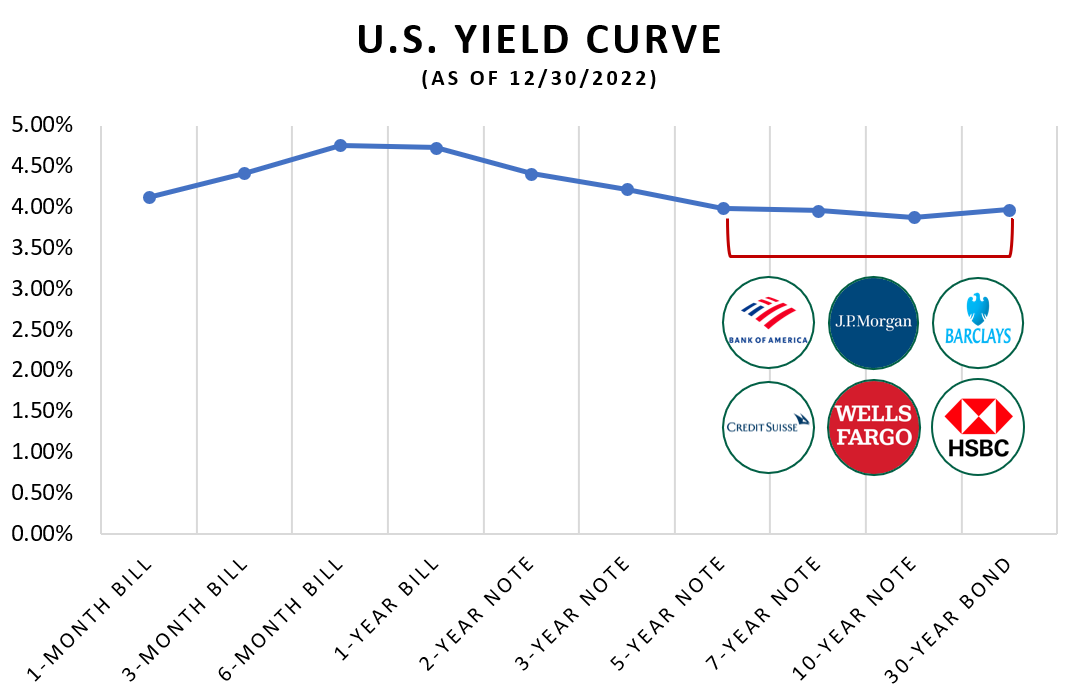

Recommended allocation when rates are expected to fall:

Growth and Recession Predictions

While Barclays and Citi expect global growth to be 1.7%, Goldman Sachs has a more optimistic expectation of 1.8% because of unprecedented job openings, normalization in supply chains and rental housing markets, and an expected decrease in commodity prices. Barclays listed projections for the U.S. labor market; however, they are certain that the U.S. will see large job losses and Fed policy will be very restrictive.

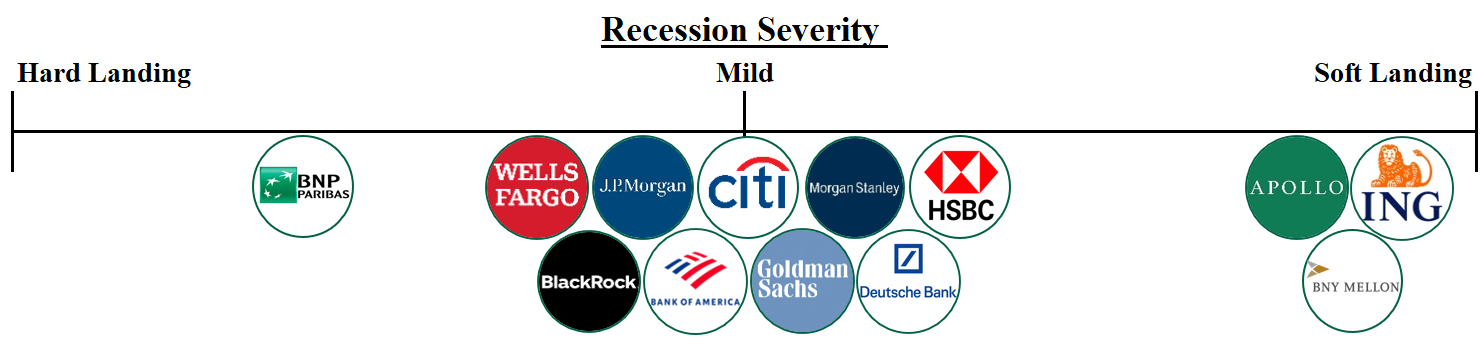

The majority of bulge bracket banks expect the U.S. to fall into a mild recession in 2023 due to less supportive fiscal policy, geopolitical uncertainties, Nonfarm Payrolls, declines in consumer demand, and the loss of purchasing power for households. However, Blackrock believes that if the Fed wants inflation levels at 2%, a recession needs to happen by decreasing demand, decreasing GDP, or living with high inflation. Citi emphasizes that if the Fed holds its rates longer than the market anticipates, this can create a deeper recession.

Many banks believe inflation will be sticky in 2023, increasing the federal funds' target range. JP Morgan and HSBC inform that markets are pricing a terminal rate close to 5% in the U.S. Blackrock, Goldman Sachs, and Fidelity sees central banks stopping their rate hikes once economic damage becomes apparent. Bank of America believes the only way to wipe out inflation is by a cooling job market, improvements in supply chains, and stable commodity prices.

ESG

Environmental, social, and governance (ESG) is an important topic in 2022, and companies are committing to researching and demonstrating a link between actions and financial results. Government regulations on disclosing ESG information will create a more transparent framework for evaluating investments and engaging with companies. Bank of America suggests holding both traditional oil stocks and renewables as the world transitions to cleaner energy. The energy transition is a vital part of ESG investments and will continue to be a key criterion in valuations.