2023 - Mild recession vs. Ragnarök

This report was written by:

Tim Frenzel, CFA, MBA, FRM

Head of Data Analytics & Research

Tim leverages 14 years of asset management & data science experience to lead our RDA team. He drives the firm's macro research, asset allocation strategy, and data science initiatives. In his previous role as lead portfolio manager, Tim managed $1.6bn across quantitative, multi-asset, and hedge fund strategies, receiving consistent 5-star ratings on Morningstar for his flagship fund. He has expertise in alternative beta, GTAA, and machine learning, having developed various tools for risk management and portfolio construction. He holds an MBA, a bachelor's in quantitative finance, and both CFA and FRM certifications.

Bennett Fees

Economic Research Associate

Bennett assists our RDA team by keeping us updated on the Federal Reserve, macroeconomic shifts, and flags potential risks to our portfolios. His white papers and other contributions are available on the Insights blog.

Hoskin Capital’s Annual Wrap-Up Report

Tim Frenzel on a beach in Namibia, not far from the desk where he started writing this report.

The past three years have seen a fast pace of economic contraction and recovery, a new ground war in Europe, and nuclear warnings from global leaders. In 2023, we will be tested again, but it is in these moments of adversity that we find out what we're truly made of. Will we rise to the occasion and come out stronger, or will we succumb to the difficulties that lie ahead?

The market consensus indicates a few bumps in the upcoming months but then a soft landing towards the end of the year. The job market looks good, most risk scenarios are already priced in, valuations seem attractive, the Federal Reserve has its eyes open, and surely the Real Estate market will settle in soon.

Still… I don’t want to ignore a possible Ragnarök entirely. As the COVID pandemic so brutally reminded us, black swan events are always with us and the risk of overlapping shocks and the possibility of a trigger event causing a ripple effect across world markets should not fall outside of our realm of the thinkable. We even might stand at the beginning of the transformative and chaotic process Ray Dalio describes in his book ‘The Changing World Order’. Many indicators for a shift in the global balance of power are in a dangerous state, such as global economic growth gaps, rising wealth inequality, political turmoil, and more. For those who have a more positive outlook on the economy but still want to have protection in case of another 20% downturn, I have provided some tools below. But let's set aside these very bearish thoughts for a moment and examine the current state of our economy instead.

Monetary Policy

It’s odd to think that just a year ago, when the inflation break-even rate in the US bond market was 2.19%, inflation expectations were well anchored and faith in the Fed seemed relatively stable. Of course, Russia’s invasion of Ukraine in late February changed all of this as Ukraine’s defense cemented supply shocks into a longer time horizon creating a toxic situation when mixed with pent up demand from lockdown. In fact, one of the most important things we know about inflation in 2022 is precisely how little we knew. This graph from Apollo conveys this very well.

Taking this to heart, the most stable operating view is that inflation is cooling but will take quite a bit longer before it reaches the Fed’s preferred 2%. Apollo notes that historically it takes 2-3 years and members of the FOMC also indicate that inflation will not reach the 2% target in 2023. This historical consistency across developed economies is mostly due to the lagging and indirect nature of monetary policy but is foregrounded by a tight labor market and supply chains that have struggled to adapt to quickly moving macroeconomic factors.

While some cuts remain possible if not likely in 2023, this stickiness should make us hesitant to call any cut a strict “pivot” unless ‘something breaks’ and there is a serious downturn in the economy. The ‘peak but no pivot’ viewpoint is taken even farther in Credit Suisse’s predictions which argue that because of inflation’s stubbornness, no developed countries will cut interest rates at all. Their prediction is a bit suspect, however, as it hinges on central banks not cutting rates as long as inflation is above their targets; an idea less straightforward than it appears since the 2% target is unlikely to be recklessly chased once inflation starts to ease if it comes with an increased economic slowdown. The reasoning of Olivier Blanchard’s revitalized argument for a revised target (something the Fed has no plans to do) is a helpful factor to keep in mind as the tradeoffs inherent in monetary policy become less clear as inflation subsides. For reference, here is a useful graph from Reuters visualizing where we are now.

Looking at the components of inflation, however, is more complicated. What seems to be clear is that price inflation is likely to have peaked while wage and services inflation are still a problem. For instance, Core PCE, the Fed’s preferred measure of inflation, showed prices for goods dropping 0.4% while services rose 0.4% in the December report. Intimately related to this picture are wages which make up a substantial portion of the cost to provide services. The recent declaration in wage growth from Friday’s job report and the decline in services prices measured in the Friday’s ISM services report show some progress but make the current moment very anticipatory for how this data will affect Thursday’s CPI reading. What’s more, is that the past CPI reports have resulted in a daily S&P futures trading range of 4% in December and over 5% the preceding three releases. On the wage inflation side of things, it won’t be until data from the Atlanta Fed’s Wage Growth Tracker and the Employment Cost Index for Q4 that we will get a better picture of what the FOMC will be looking at.

Despite these promising signs, both Daly and Bostic have been notably hawkish and are on the 25/50 bp fence for February with a 5% terminal rate in sight. Regardless, the market is convinced that rates will continue to rise into 2023 and be held there for sometime. This position was revealed most notably in the December minutes where members observed that a restrictive policy would need to be “maintained” until inflation was consistently decreasing and that history strongly cautions against prematurely loosening. In turn, interest rates will rise around 5% with the most important debates coming later in 2023 around whether modest cuts should be made. This, of course, assumes nothing ‘breaks’ in which case cuts will most definitely follow but would be eclipsed by whatever sector of the economy takes the biggest hit.

U.S. Economy Slides in 2023 | Financial Markets stabilizing

In terms of the impacts of monetary policy and other structural forces at play on the economy, the consensus is that the US will have a mild recession in 2023. The best case would of course be soft landing. These arguments usually rely on counteracting measures to balance tight monetary policy. Member of the White House Council of Economic Advisors Heather Boushely, points toward the Bipartisan Infrastructure Law, the Chips and Science Act and the Inflation Reduction Act as three policies that should bolster the employment level and cushion the economy’s landing.

The worst case scenario remains a hard landing with robust arguments for a stagflationary 2023. There are many reasons why the more pessimistic viewpoints have been less popular. First of all, the determination of the Federal Reserve and their capability to decrease inflation. It has been at the top of Jerome Powell’s mind with him directly saying that premature loosening would be unwise. Ben Bernanke just recently stated that the current economic situation is not as dire as it was in the 1970s due to the fact that central banks now prioritize inflation control and have a higher level of credibility. Additionally, the Federal Open Market Committee (FOMC) emphasized in their December meeting minutes that a slowdown in rate increases should not be interpreted as a lack of determination to achieve their goal of maintaining price stability. A second reason is Fed efficacy in “demand destruction”. Two sharp monthly declines in new housing permits in October and November and wage growth decelerating the most since December 2020 both point towards the lagging effects of monetary policy starting to come into effect. Wage growth is particularly vital given that the often-referenced tight labor market is less about the employment level proper than the amount of job openings which puts upward pressure on wages. This is why people like Former Fed Governor Randal Krosner argue that decelerating in wage growth rather than fewer jobs is what the Fed is looking at when it comes to interpreting the December jobs report. That said, this section should be taken with the biggest grain of salt since this data is too recent to call. If we look at Total Private Indexes of Aggregate Weekly Payrolls of Production and Nonsupervisory Employees - a reliable concurrent indicator that has been declining and turned negative year-over-year mostly during each recession on a quarterly basis - we can see that monthly readings have been consistently declining since August but have room before they reach a recessionary level in historical context. A third factor contributing to the soft landing argument is the strength of the economy, including household finances, bank finances, and the labor market, which is expected to prevent a severe recession, according to the Wells Fargo outlook outlook which predicts a short recovery after a moderate downturn. According to the December minutes, the FOMC believes that the business sector has a moderate outlook, with high borrowing costs hindering investment and supply side issues affecting different industries differently. In any event, it is clear that at present, the Federal Reserve's focus is solely on achieving its mandate of controlling inflation, as opposed to also striving for maximum employment.

While our pathway through 2023 remains moderately positive we should be aware that as the United States faces multiple challenges simultaneously, there is a risk of an overlapping of shocks that could trigger a worst-case scenario. This scenario could involve a cascade of impacts that ripple across world markets and the economy. As outlined by the Citi Global Outlook, one example of this risk is the decision by the US administration to limit US content in China's computing industry. This move has the potential to disrupt the trade of intermediate products such as semiconductors, which could have a much larger impact on the economy than the value of individual components might suggest. Additionally, policymakers have used massive fiscal and monetary stimulus in response to the COVID-19 shock, which has tested the limits of the global economy and led to inflation. If not properly managed, this persistent inflation could also contribute to a worst-case scenario. While it is important to note that the vast majority of geopolitical shocks since WWII have not caused turning points in economic activity, it is crucial to be aware of the potential exceptions and take steps to mitigate risk.

Real Estate Market? We will be fine…

The real estate market is expected to face challenges in 2023 due to rising interest rates and weaker economic growth. On the positive side, segments such as multifamily rental properties and e-commerce-related properties (e.g. warehouses and distribution centers) are experiencing strong demand. The US is projected to need an additional 4.3 million apartment units in the next 10-12 years, which could sustain demand for multifamily homes. REITs are expected to perform well due to their high margins and operating efficiency. Niche sectors such as student housing, senior housing, healthcare, and self-storage are gaining popularity as investors allocate capital to these sectors with counter-cyclical demand drivers. ESG considerations are also becoming increasingly important for investors, occupiers, and employees.

On the negative side: Inflationary headwinds may impact the retail real estate market, affecting landlords and occupiers. While higher interest rates are increasing financing costs and making it more difficult for buyers to afford mortgages. As of November 2022, the US mortgage rate was near a 20-year high of 7.2%. The cost of renovating and developing properties has also increased due to inflation, making it more expensive for developers and investors. These factors, combined with the average monthly mortgage payment becoming more expensive compared to typical monthly apartment rental payments, may make renting more attractive for potential buyers. In Q3 2022, the average monthly mortgage payment was about $900 more expensive than a typical monthly apartment rental payment, compared to a difference of $380 in 2018. A stabilizing interest rate environment may be beneficial for real estate investing, but office utilization rates and demand may remain low due to continued work-from-home policies and the hotel industry having a slower recovery for corporate properties. Additionally, a slower recovery of credit and lending markets may cause investors to redirect capital into equities and fixed income, leading to slower fund flows into real estate.

What are the opportunities for investors? Multifamily homes, e-commerce related properties, and quality offices in select locations may be good investments due to favorable supply and demand fundamentals and strong demographic trends. Logistics and green buildings may also be areas of opportunity. Quality assets and alternative property types such as student accommodation and build-to-rent housing should be focused on, and international markets should be considered for diversification. However, investors should be cautious due to the potential for a decline in asset values and rental growth, as well as the risks posed by higher interest rates and a possible recession. Although opportunities are still out there, it is important to be aware of the risks such as declining asset values and rental growth, as well as the potential for rising interest rates and a recession, and proceed with caution.

The growth of Airbnb and short-term rentals has significantly impacted the real estate market, introducing a relatively new aspect to the industry. While these platforms have attracted investors to build large portfolios of properties specifically for short-term rentals, they have also been funded with risky loans based on future earnings rather than down payments or borrower salaries. If the short-term rental industry were to decline, it could lead to financial problems for investors and the banks that funded them. However, stricter lending standards for residential mortgages mean that a housing crash similar to the one between 2008 and 2014 is not expected. However, the impact of Airbnb and short-term rentals on the real estate market is not entirely negative. In fact, a study found that there is a long-term positive relationship between Airbnb densities and rental rates, as measured by the Zillow Rent Index. The increase in supply of short-term rentals in the US, which reached 1.38 million listings in September 2022, a 23% YoY increase, has led to a decline in occupancy rates for some hosts as bookings are spread across more properties. This increase in supply is partly due to the number of wealthier individuals who purchased second homes during the pandemic, boosted by low interest rates and the ability to work from anywhere. However, some cities and states have implemented regulations and restrictions on short-term rentals, which could impact the industry and investor profitability.

Job Market? I work remote…

Despite continued fear of a recession, the US job market remains strong, with low unemployment rates (historic low of 3.5%) and a robust 223,000 new jobs added in December alone. The healthcare, education, and hospitality sectors saw the most job growth during this time, while the electronic products, information services, and administrative services sectors saw a decline. Lower wage employees in the service sector are experiencing strong wage growth due to higher income workers having excess savings to spend in the service sector. The personal savings rate has dropped significantly in recent months, with an average of 2.6% in the last six months, compared to the average of 8.8% before the pandemic. However, the outlook for the job market is somewhat uncertain due to a weakening of consumer demand and an expected decline in non-farm payrolls in 2023. The civilian labor force is currently 3.8 million workers below the pre-pandemic levels, making it difficult for employers to find workers and leading to a tight labor market. The jobs-worker gap, a widely recognized metric for analyzing the balance between employment opportunities and the labor force, has recently decreased to just over four million. While this figure remains slightly higher than historical averages, it indicates a potential cooling of the job market. Interestingly, the excess in the labor market currently comes more from companies seeking to hire workers rather than actually hiring them. The decrease of the labor participation rate may be also driven by demographic factors such as aging baby boomers retiring and young people staying in school longer. The Federal Reserve believes that the high number of current job vacancies reflects the reorganization of the labor market and economy following the pandemic. Moreover, companies may move towards a model similar to those in Europe, where employees are kept on the payroll during recessions for a smoother recovery later.

The technology sector has experienced some high-profile layoffs. Collectively, employers in the slumping tech sector cut more than 150,000 jobs in 2022, based on estimates from Layoffs.fy. For years, many tech companies aggressively added workers amid strong revenue growth and rising share prices. The hiring pace picked up during the pandemic as individuals and companies leaned on technology to help get through lockdowns and other Covid-related disruptions. Despite this, the technology sector has not had a significant impact on the job market in the US, as the current decline in participation rates is not significantly different for those in the technology sector versus those in other industries. But the technology sector is expected to play a key role in the job market, particularly as the world moves towards Industry 4.0. This revolution involves advances such as the smart factory, autonomous systems, and ML/AI, and has the potential to provide new job opportunities and lead to a more sustainable, efficient society.

Remote work certainly left its mark on the job market over the past two years, with many companies shifting to remote work due to the COVID-19 pandemic. This shift has led to both positive and negative effects on the job market, with some companies experiencing increased productivity and cost savings from remote work, while others have struggled to adapt and have faced layoffs. While the significant growth during the pandemic has now leveled off, we expect the remote job market to continue to evolve in 2023.

Risk Management? You are already soaked but lets talk about 2023…

As we approach 2023, the question on many investors' minds is whether the traditional 60/40 portfolio will stage a comeback. With negative returns of -19.2% in 2022 and correlation between stocks and bonds turned positive due to persistently elevated inflation and central bank tightening campaigns, these portfolios have struggled. However, the 60/40 portfolio may seem more attractive due to cheaper valuations at the moment. But don't be fooled - based on the current economic landscape, it seems unlikely that the 60/40 portfolio will rise back to popularity any time soon.

60/40 portfolios tend to perform well in scenarios of low and anchored inflation, where there is a structural "Goldilocks" scenario with falling inflation and real rates boosting valuations and strong profit growth. This was seen in the period following the financial crisis, when both bonds and equities rallied together under the banner of a high Sharpe Ratio. Additionally, 60/40 portfolios may perform well over long time horizons due to equity risk premia being positive over the long run.

In times of high and rising inflation, however, 60/40 portfolios may struggle due to the negative impact on equities, particularly leveraged or long duration stocks. Additionally, inflation erodes the value of bond holdings, leading to poor returns for the portfolio as a whole. The diversification benefits and buffer provided by bonds in a 60/40 portfolio are also reduced in a scenario with low yields and sticky, elevated inflation. This was seen in the 1970s stagflation, when 60/40 portfolios experienced poor performance due to the decrease in real returns from bonds and the reduced diversification benefits. There have been nine more instances since 1980 in which the 60/40 portfolio declined more than 10% within a year.

So, what can an investor do to improve the performance of a 60/40 portfolio?

Our advice: Consider rebalancing into higher yielding and defensive stocks or convertibles, identify and manage equity styles (value!), implement tactical asset allocation and/or volatility targeting and momentum overlays, include real assets, value stores, trend-following managers or even option strategies.

High yield stocks can provide attractive yields after inflation and may outperform in stagflation and crash scenarios- during the stagflation scenario in 1970s and Dot-com crash in 2000s! Tactical asset allocation can actively manage the portfolio based on macroeconomic outlook and valuations. Equity factor premia (aka ‘styles’) may be beneficial in the current environment. US value stocks generally outperformed growth in periods of high and rising inflation and the recent higher rates volatility (inflation risks) has led to some large rotations between growth and value.

Real assets, such as commodities and real estate, may provide uncorrelated returns and competitive real return potential in inflationary times, but come with additional risks and may not be suitable for all investors. Gold and safe haven FX may be considered as options for preserving value in the case of currency degradation or devaluation. Market-neutral trend-following strategies, such as CTAs, and volatility targeting and momentum overlays can mitigate market risk and improve portfolio performance in inflationary times.

In summary, the 60/40 is facing potential near-term challenges due to rising interest rates that may lower bond returns and downgraded earnings expectations for stocks. Additionally, the factors that have previously contributed to the 60/40 portfolio's success - such as slowing inflation, declining real yields, and supportive Federal Reserve policies - are expected to decrease in the future, potentially preventing the portfolio from going back to its average long-term return of approximately 7% per year.

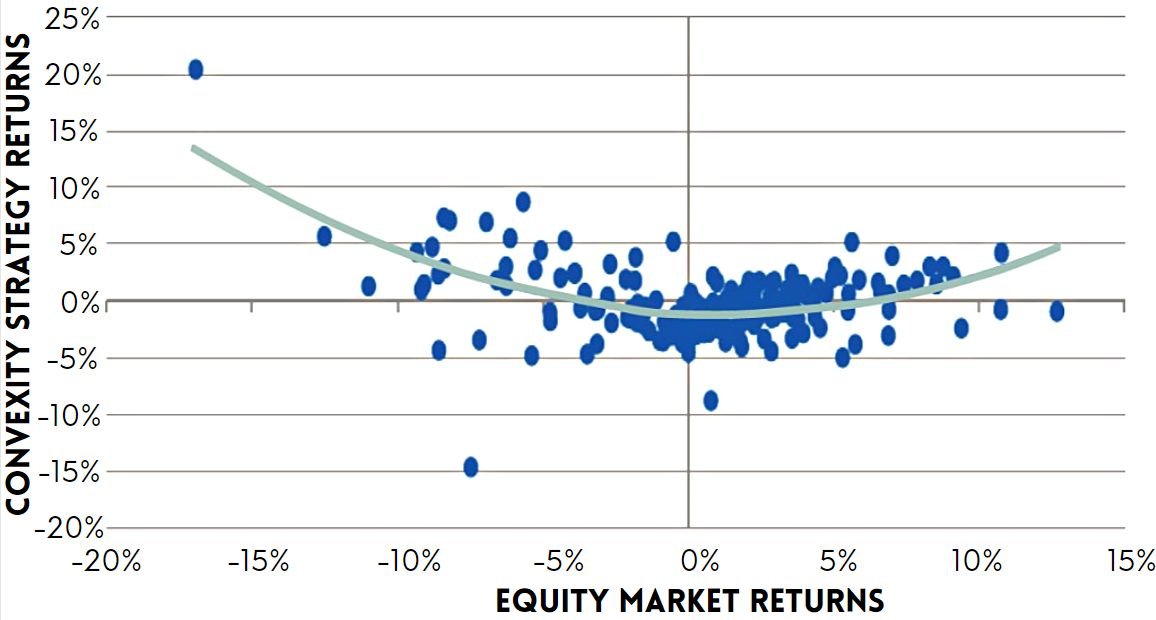

Time to consider Convexity?

Convex hedging strategies aim to reduce the sensitivity of an investment portfolio to changes in market risk by causing the portfolio's value to change at a progressively slower rate as the underlying market risk increases. This property can help to reduce the volatility of portfolio returns and make them more predictable. It can also potentially mitigate risk by causing the portfolio to increase in value as market conditions deteriorate and inflation increases. If the market experiences a decline, the value of a convex investment may rise, which may allow the investor to sell the investment for a profit. This profit can then be re-deployed into traditional markets at attractive entry points, potentially generating additional returns in the future. But convexity can also be a double-edged sword, as these strategies can increase the risk of loss if the underlying risk factor moves in the opposite direction than expected.

There are several methods that investors can use to add convexity to their portfolio management, such as options-based strategies, systematic strategies, and risk-mitigating futures overlays. These strategies have performed well this year, with an average return of approximately 10.6% in the first three quarters of 2022. As an institutional investor who has spent several years developing convexity strategies, I am a strong advocate of these types of investments. However, the implementation of convexity strategies can be complex and it is crucial for investors to thoroughly consider the potential risks and rewards before using them as a hedging strategy. It is also advisable not to try to time entry and exit points in these strategies.